How private are you?

I recently read a post on social network/news aggregator Reddit detailing exactly how the OP (original poster) had defrauded an insurance company. The OP was certain their identity was secure, and that the insurance company in question wouldn't be able to identify them. Furthermore, they believe their crime spent under the statute of limitations.

This scenario plays out differently for millions of citizens. Insurance companies are profit making businesses, many with liabilities to shareholders. Of course, this means reducing their potential liabilities to their customers -- people like you and me.

I'm sure part of you understands, and maybe even sympathizes with the insurance companies. After all, fraudulent claims increase premiums, among other triggers. On the other hand, insurance companies use increasingly invasive tactics to investigate and verify a potential claim, keeping fraudulent and other malicious claims low.

How far do they go? Is it too far? And most importantly, is it legal?

The Age of Information

The so-called age of information presents an evolving landscape of data. Insurance companies are all-too aware that hundreds of millions of individuals post and share private information across a sometimes startling array of public websites. Even if we ignore social media platforms, the majority of us leave an easily-unpickable digital trail.

A number of variables are considered when you apply for insurance. Your age, location, profession, previous insurance history -- including claims and cancellations, and even your credit history -- will be taken into consideration. You can see the differentiation between the data types I've listed above. Insurance customers willingly provide their age, date of birth, and so on. But when you ask for that quote, your potential insurer will trawl through the myriad public records available.

Detailed Personal Questions

The amount of information you're required to give relates to the type of cover you're trying to take out. For instance, Public Citizen, a non-profit consumer rights advocacy group, received a shock when they decided to shop around for a new medical health insurance provider:

What disturbed us were not so much the prices -- we're used to annual sticker shock -- but the questionnaires that we received from several of the new bidders. They wanted to know more than how many employees we had, how many dependents, and of what ages; they required detailed personal medical histories on everyone who would be covered.

Granted, this was in 2001, but the questions haven't changed. Medical insurance companies want to ensure the policy they issue is robust, without entertaining the chance of a payout. And even if you have excellent health, you'll be punished by those who don't.

Genetic Predisposition

Keeping insurance premiums low is a major concern for many U.S. citizens. However, genetic testing is now cheap and easily accessible. As such, some insurance companies explored the option of having potential policy holders undergo a mandatory genetic test. You'll be pleased to know that several laws at the state and federal level exist to prohibit insurance companies using genetic testing to discriminate against potential policy holders:

Genetic discrimination occurs when people are treated differently by their employer or insurance company because they have a gene mutation that causes or increases the risk of an inherited disorder. Fear of discrimination is a common concern among people considering genetic testing.

The Genetic Information Non-Discrimination Act (GINA) is designed with exactly this in mind. GINA is formed of two parts. Title I protects against genetic discrimination in health insurance, and Title II protects against genetic discrimination in employment.

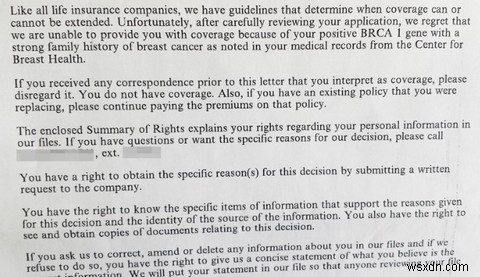

However, GINA doesn't entirely protect, at least not in every circumstance. You see, while GINA may apply to health insurance, it doesn't cover other major policies, such as life, disability, or long-term care, as well as other specified scenarios. The knock-on effect of this can be devastating.

For instance, an application for life insurance can easily be turned down if genetic test results are revealed to a potential policy provider.

12% of the general population will be diagnosed with breast cancer. By contrast, an estimated 55--65% of women with a BRCA 1 mutation will develop breast cancer by the age of 70. The life insurance industry has only one thought though: our business model will crumble if we accept millions with cancer and other genetic diseases.

In Your Car, Too

The detailed questions are not limited to medical insurance. Usage-based insurance (UBI) policies ask a different set of questions, as well as asking a potential insurance recipient to install a device in their vehicle. Your premium will ultimately be shaped by your age, location, gender, driving history, and vehicle, although your profession and home-ownership status will also be considered.

Usage-based policies present a different problem though. The driver acquiesces to a tracking device installed in their vehicle. As well as considering the previously mentioned variables, a usage-based policy uses telematics to gauge your premium. Measurements vary from provider to provider. Some providers exclusively consider mileage, while others consider average speed, braking habits, time of day, speed, acceleration, and the location of travel.

Where does the tracking stop? David Marlett, IIANC Distinguished Professor of Insurance at Appalachian State University considers usage-based insurance akin to social media, at least in terms of information sharing:

Many people appear to be comfortable with sharing location and their personal information through social media, so this isn't really much different. Many insurers already use social media in their underwriting and claims investigations without consumer consent.

Of course, this means we're probably okay with information being siphoned from everywhere, right?! And that is without even considering the final sentence of the above quote. Don't worry, we'll look at that next!

A UBI policy may potentially save money throughout the course of a year, but I would certainly investigate the insurance company and their data usage policy before signing-up.

Self-Snitching Socials

Facebook has over 1.7 billion users. In 2015, there were roughly 3.3 million posts every 60 seconds. People share all manner of information, sometimes without a second thought. That post about how much you hate Donald Trump or Hillary Clinton will remain online forever. This constant stream of personal information hasn't gone unnoticed by insurance companies.

Facebook recently barred a U.K. insurance provider's plans to view young drivers' timelines before setting an insurance premium. Admiral wanted new drivers' permission to judge their posts and likes as to ascertain their safety as a driver:

"Protecting the privacy of the people on Facebook is of utmost importance to us. We have clear guidelines that prevent information being obtained from Facebook from being used to make decisions about eligibility," said a Facebook spokesman. "Our understanding is that Admiral will then ask users who sign up to answer questions which will be used to assess their eligibility."

The app would have been the first of its kind in the U.K. Algorithms would scan a young person's timeline and Facebook account. The algorithm would then judge elements such as their level of organization, their sentence structure, use of grammar, use of lists, and even down to the level of "confidence" shown in posts.

Personally, this sounds horrific, but only because I've posted all manner of random content to my Facebook feed. However, Dan Mines, who led the firstcarquote project at Admiral was quick to stress that "it is incredibly transparent. If you don't want to use it in a quote then you don't have to. We are doing our best to build a product that allows young people to identify themselves as safe drivers."

Surveillance

Insurance providers have numerous tools to ascertain if a claim is legitimate. But where there is doubt, and certainly in prolonged or expensive claims, an insurance company might use surveillance. This involves gathering evidence that can be used against a potentially fraudulent claim. It is a key tool in many anti-fraud strategies. Nonetheless, it leaves those under surveillance with feelings of breached privacy, understandably.

Social media posts are not excluded from this surveillance, either. Digitally updating information grants insurance companies and their investigators an easy window to peer through, without alerting anyone to their suspicions. The process certainly cuts down on fraud, but turns insurance into a more transient, evolving product.

I don't think many people are prepared for their insurance provider to dynamically update the product they purchased. On the other hand, social media isn't "new," but it does keep growing. Educating new users, whether young or old, will certainly aide social media privacy, but isn't the be-all-end-all many would like.

A Careful Balancing Act

Protecting our privacy is a major concern. In an age where many Americans appear to be giving up on privacy, and our personal information sharing is constantly rising, insurers don't have to look far to uncover the data they need.

In my opinion, if you're defrauding an insurance company, you have to expect to have your privacy breached. After all, you're breaching your contract, which I'm sure you don't need me to tell you, is a potential federal offence. Likewise, you're not just defrauding your insurance company. You're actively increasing premiums for other hardworking citizens.

Where do you draw the privacy line with insurance companies? Should they be barred from social media? Or is it up to the individual to moderate their posts? Let us know your thoughts below!